Defi as we know it is a convolution of finance engineering and incentive design. Projects with well-designed incentives win massive power and wealth. In the end, it all boils down to discouraging users from selling tokens and encouraging people to buy your token to prop up the liquidity and price. Hence, the emergence of marketplaces for liquidity, where leading protocols can aggregate various opportunities for users to earn yield income by providing liquidity. And where protocols can pay investors to help them increase the liquidity of their tokens. This aggregation calls for competition and in crypto, where all projects need clout and TVL, intense competition turns to battle. Then it escalates to war.

Each player must seek to increase TVL by offering attractive yields to their users. The game only ends when all is dead. The name of the game is… “The Curve Wars”

The Curve war is a race between various protocols that are continuously trying to ensure that their preferred pools are offering the highest $CRV rewards while users who lock $CRV into veCRV get huge farming incentives in the form of $CVX, $SUSHI, and $SDT and receive trading fees from the automated market maker, governance rights, and boosted rewards. As you can see, Curve tokenomics is very generous as it splits its transaction fees between CRV token holders.

But before we get into the intricacies and facts about the Curve wars, let’s first get to know more about the platform that laid the foundation for all these.

Curve Finance:

Curve Finance is a decentralized exchange designed to provide the best possible rates for users who are trading stablecoins. It also has a native token known as $CRV. Curve finance focuses on stablecoins, which means that liquidity providers are at lower risk since volatility is lower. Its rapid growth can be attributed to its tokenomics and growth of yield optimization protocols.

The mathematics behind Curve Finance is amazing. Their algorithm allows for a very high transaction volume with extremely low slippage with swapping mathematics that makes them an exceptionally efficient platform compared to other DEXes.

Uniswap led the way for Decentralized Exchanges when they launched their trading platform and introduced the “Constant Product Formula” x * y = k. This worked great for trades that only used a small amount of the total liquidity of a given pool, but it had a downside. If a trade was going to use a significant percentage of the liquidity in the pool, it would have a significant price impact because you’d be dramatically changing the balance of the two tokens in the pool. This was a particularly bad problem for stablecoins as it made it very expensive to swap between tokens like USDC and DAI which should be worth the same. Small amounts were fine, but larger Defi protocols didn’t have a good way to swap around millions of stablecoins without losing some in the process.

In comes Curve. Curve took the Constant Product a step further and introduced their “StableSwap Invariant.” Michael Egorov, the founder of Curve, demonstrated in his Whitepaper how he figured out a way to combine a linear constant with a product constant that allows having such a low slippage while using Curve pools. The Curve AMM is optimized to trade like-kind assets in the way that even if the 2 assets aren’t equally weighted in the pool, they can still be on a 1:1 price. The maths behind it is quite complex. So, you’ll have to read it directly from their whitepaper.

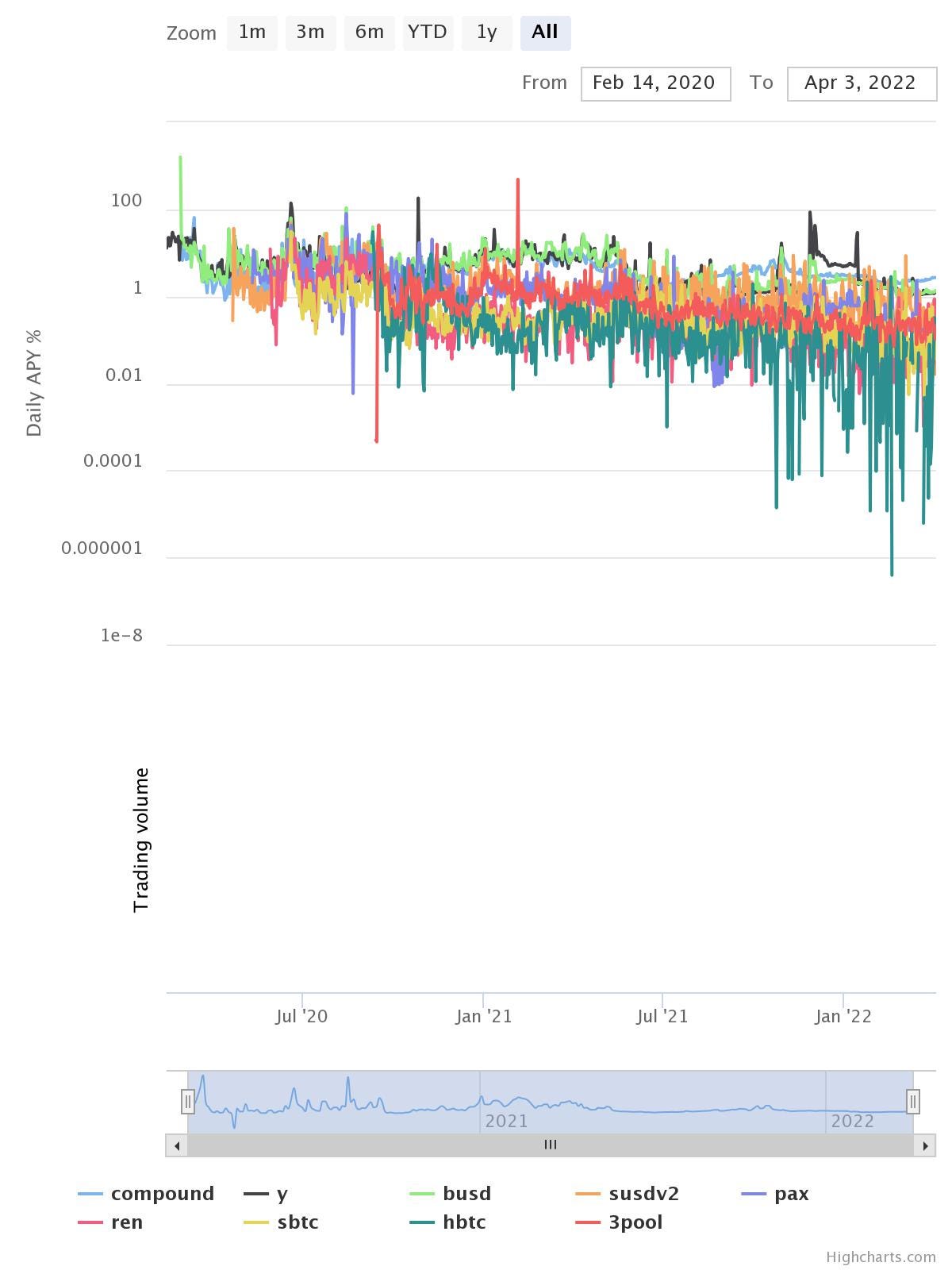

The most important thing to note is that for large transactions between stable pairs, Curve can dramatically reduce the price slippage and enable much more efficient trades. This made Curve become the go-to platform for doing swaps between stablecoins, and they consistently have significantly more TVL than their competitors.

The curve is indeed fascinating but the stem of the Curve wars is the incentive structure around its governance token: CRV.

When you provide liquidity to a trading pool on Curve, you earn a share of all the trading fees on that pool. But you also earn some CRV tokens, as a bonus incentive to you for providing liquidity to that pool.

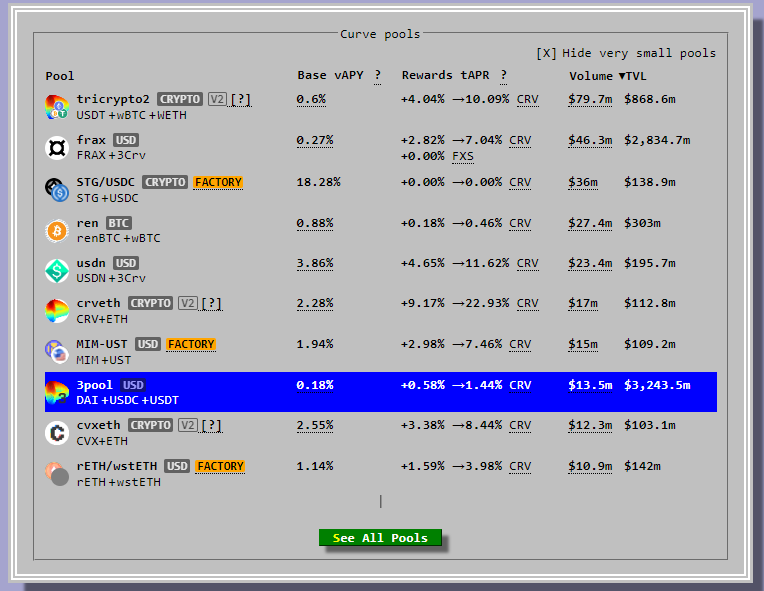

For example, the Curve “3Pool” with DAI, USDC, and USDT, is one of the most liquid pools in all of Defi doing $13.5m of volume in the last 24 hours.

Curve’s Tokenomics: The veCRV Model

The main purpose of the CRV token is to incentivize liquidity providers and users on Curve Finance to get involved in the governance of the protocol. It has three main uses: voting, staking, and boosting. Those three things will require you to vote lock your CRV and acquire veCRV.

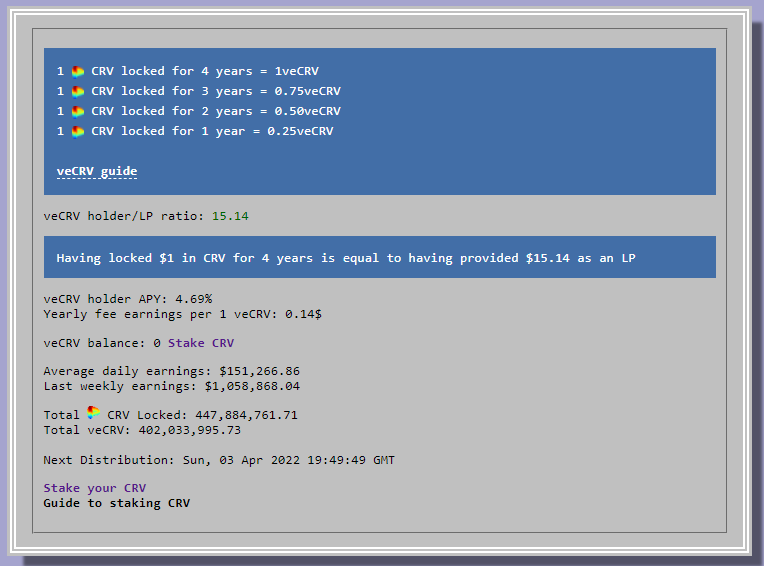

veCRV stands for vote-escrowed CRV, it is simply CRV locked for some time. The longer you lock CRV for, the more veCRV you receive.

As you can see, the value behind the Curve token is split in two. i.e the revenue share component and the governance aspect of it. The CRV token provides access to a 50% share of the fees collected and a voting power to influence the issuance of future CRVs. So, having control over a large CRV voting power makes it much easier to develop a Curve pool, since it offers the possibility to vote for large CRV returns on the pool in question.

For every trade that occurs on Curve, liquidity providers earn a percentage of fees in the form of $CRV tokens. Curve users lock their $CRV to get a veCRV. The lockout period can be set between 1 week and 4 years. Once you lock your veCRV, you will not be able to retrieve it until the lock period expires and you will no longer be able to redeem your CRV. At the end of the period, you get your CRV back and Curve will pay you an additional CRV in proportion to the veCRVs that have been locked to induce a long lock-in period.

The system is designed to provide 1veCRV per 1CRV for 4 years lock-in, 0.5veCRV for 2-year lock-in and 0.25veCRV for 1-year lock-in. Also, the longer you lock, the higher bonus reward you will get while providing liquidity on a pool.

Currently, Curve has a lock-up rate of almost 62% of the amount of CRVs in circulation, with an average lock-up period of 3.63 years. Even if the full supply of Curve tokens is set up to be complete in 300 years, the curve emission strategy is very aggressive as it’s inflating at an insane amount. The only reason it’s not resulting in a complete dump of the token’s value is that everyone’s locking it up for 4 years, then locking their reward for 4 years too, and then re-locking the reward that they get for 4 more years so that they can get more reward. A virtuous circle, as long as most of the LPs stay in the circle.

In other words, the longer you commit to the lock-up of your CRV, the more trading fees you will receive. The passive income is just one bonus though. As a veCRV holder, you also get to “boost” your rewards in the different CRV pools. If you remember above, most pools had a range of reward rates. Like the 8.59% to 18.59% for the Wormhole UST-3Pool. You get 8.59% if you have no veCRV. But as you acquire more veCRV, your reward rate increases until it hits the 18.59% max.

If you believe in the Curve ecosystem, it makes the most sense to provide funds to the liquidity pools, claim your CRV rewards often, and then stake them for more veCRV so your reward rate increases. Also, the more votes a pool gets, the more CRV LP stakers will receive, and so theoretically more people will stake in that pool. As an individual, this isn’t a huge power since you’ll probably just vote for whatever pools you have your funds in. But as a protocol who has a token on Curve, this is massive.

veCRV votes are very powerful for any protocol that wants to get more liquidity for trading their token, and this is what lays the foundation for the Curve Wars. Accumulating liquidity is one of the main priorities of any Defi protocol, and the more veCRV you have, the more liquidity you can direct towards your tokens. The winner of the first war was convex finance; a protocol that marketed itself as an aggregator for Curve yields. Instead of delving into Convex finance now, I’ll just share a link.

CVX: Bribe Economy

Convex has managed to lock around 200m CRV tokens for veCRV since its inception. There are currently 35.9m CVX tokens locked for voting on Convex, which means every CVX token can direct about 5.57 veCRV token votes. So to control those votes, you either need to buy CVX tokens, or you need to pay people who have CVX tokens to vote for you.

This is where bribes come in. Protocols will pay CVX holders to vote for their pools, based on the assumption that over time it will be cheaper to pay CVX holders than to acquire more CVX. These bribe amounts change semi-weekly based on the competition from other protocols trying to bribe CVX holders.

So instead of spending $37 (as of the time of writing) to buy one CVX to vote, protocols can pay CVX holders $0.40-$0.80 per vote. That’s a great deal if your goal is just to maximize the votes to your pools! Of course, this is a great deal for CVX holders as they earn a 2.25% APR from the Convex Platform fees and 42% APR from bribes.

Convex already won on Curve. So now the question is: who will win the Convex wars? If Convex won the Curve war by controlling all the veCRV, then whoever controls the veCVX could win the Convex Wars.

REDACTED Cartel is a protocol aiming to do exactly that. On the surface, it looks like another Olympus fork with an insanely high APY. But under the hood, they’re running a highly optimized strategy to control as much of Convex as possible. It is a black hole for CVX and targeted assets via bonding.

One of the primary ways to earn REDACTED’s token, BTRFLY, is by bonding with other assets. People can buy discounted $btrfly in exchange for CVX, TOKE e.t.c But the assets they’re most interested in are CRV and CVX. The REDACTED treasury dashboard shows that over 70% of their $71m treasury is CRV and CVX tokens:

This

REDACTED is actively managed to try to win the liquidity wars for its investors while accumulating more power in the liquidity wars for BTRFLY holders. They’re deploying an optimized version of the consumer CVX bribe strategy outlined above, buying and staking CRV and CVX to earn as much additional CRV and CVX as possible, to control more votes and win the Convex war (and make a healthy profit).

So by owning BTRFLY and having it staked on their site, you’re getting exposure to the whole CRV and CVX bribing and cashflow ecosystem without having to manage everything yourself.

But REDACTED isn’t stopping there. Winning the Convex Wars is just their first step. What they want to win are the emerging liquidity wars.

The Next Era of Liquidity Wars

So we have Convex expanding to control votes on more pools. Tokemak launching to bring vote-driven liquidity to more protocols. REDACTED using a rebasing token to acquire huge shares of CVX, CRV, TOKE, and more. But this fight for liquidity is just getting started.

A new set of competing powers have come to shake out and influence liquidity moves in Defi. These new competitors are trying to create better incentive structures to aid their token’s liquidity.

This new power is called the 4pool…

Reference materials:

https://resources.curve.fi/crv-token/understanding-crv

https://kingsbusinessreview.co.uk/the-curve-wars

https://every.to/almanack/curve-wars

https://alcglobalexpress.com/warm-iqos/uniswap-bonding-curve-formula.html