For the past few weeks, I’ve been seeing some pretty wild jackshit takes about the ethereum merge on twitter and when I say wild, I mean wilddddd. And I couldn’t let you guy be deceived right?? So, I decided to write a lil something about my views, research and findings on the ethereum merge and share with you guys.

To properly understand what the merge is all about, we need to first start from the foundation of it all. We need to start our journey from Ethereum itself and why it came to be in such a situation right now.

What is Ethereum?

Ethereum is an open-source tech powering the cryptocurrency ether (ETH) and thousands of decentralized applications. By being home to a lot of decentralized applications, it fosters a community driven spirit and opens access to digital money and data-friendly services for everyone no matter the background or location. You might the question “how is it able to power thousands of decentralized application?. Well, that an easy question to answer.

As much as Ethereum is an open source tech, it’s core self is being a decentralized blockchain platform. As a decentralized platform, it establishes a peer-to-peer network that securely executes and verifies application code, called smart contracts. Smart contracts allow participants to transact with each other without a trusted central authority as these transaction records are immutable, verifiable, and securely distributed across the network, giving participants full ownership and visibility into transaction data. These transactions are sent from and received by user-created Ethereum accounts.

A sender must sign transactions and spend Ether, which is Ethereum's native cryptocurrency, as a cost of processing transactions on the network.

Now, take note of the fact above as we would still talk about it later on.

As Ethereum continued growing in user base, issues began to pop up (high GPU prices to high gas fees to environmental pollution etc.) and the most notable amongst them was the Gas fees. It’s getting insanely high!. Remember I mentioned earlier that gas fees is what makes Ethereum network go? So yeah, it's a fee paid to miners that provide the computational power to run the network. The gas price is a variable market price based on demand for resources on the Ethereum network. As the gas fees kept creeping up everyday, the average users couldn’t afford to make an Ethereum transaction anymore. That was when the plebs began to mass migrate from Ethereum to any other L1s that promised to be ethereum’s killer.

This mass migration was very worrisome for the influential people and devs in the ethereum community and I guess they sat down together to discuss and bring forth some series of proposals. As you can see, that’s a lot of proposals. So, we’re going to streamline them a bit and talk about the most important ones that concern us as traders. The ones in the thread.

Now, we’re going to talk about the ETH 2.0, EIP-1559 and The Merge.

Ethereum 1.0 Vs Ethereum 2.0

I would have loved to go in-depth about the whole Ethereum mechanism but that would make this article a bit bulky and hard to understand. Let’s just put it as this; Ethereum 1.0 uses a consensus mechanism known as proof-of-work (PoW) while Ethereum 2.0 will use a proof-of-stake (PoS) mechanism. This shift was publicly popular as it is more environmentally friendly.

The ETH 2.0 consists of three phases:

Beacon Chain (separate chain from the mainnet that launched on december 2021 by the foundation for Ethereum to switch from PoW to PoS).

The merge

Sharding (By splitting the blockchain into shards; separate chains, it kind of solves Ethereum’s scaling problems. After sharding, Ethereum would be able handle thousands of transactions per seconds).

But before all these, Ethereum released the London hard fork upgrade in August 5, 2021. A very important part of it was called EIP-1559 and the upgrade was a set of five Ethereum Improvement Proposals (EIPs). It was aimed primarily at increasing the mining speed of its native currency Ether (ETH) and incentivizing it by reducing the cost of moving data around Ethereum and increasing the scarcity of Ether itself. Now, this effectively made ETH more scarce, deflationary and theoretically more valuable.

EIP-1559 improved user experience by making fee estimation a bit easier, mitigated intra-block difference of gas price paid, and reduced users' waiting time. It overhauled Ethereum’s fee dynamics by burning most of the transaction fees and reducing the Ether being sent to miners by about 30%. Currently, this burn > new ETH being issued. The yearly inflation rate has gone from 4.3% to 1.9% and expected to go negative after the merge.

However, we need to remember that EIP-1559 has only a small effect on gas fee levels and consensus security as Ethereum is the second-largest cryptocurrency by market capitalization and this popularity comes at a cost hence leaving fees for transactions on the blockchain still quite high because of the high demand. This means that there's a scalability problem that needs to be solved. In comes the merge.

* dramatic drum roll *

The Merge

The merge is simply Ethereum’s shift from PoW to PoS.

* that’s it? that’s what the commotion was all about? *

Calm down comrade. I’ll explain more.

The Merge is where the mainnet and the Beacon chain merges so that the Ethereum mainnet also starts using PoS. So, basically this consensus is from people who lock up their ether to secure up the blockchain thereby increasing decentralization and security, sustainability and scalability for the network.

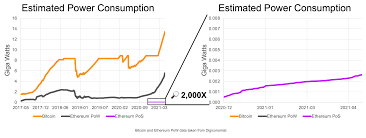

After the merge, energy consumption is expected to drop by at least 90% (people are projecting 99.5% though). This would be very good for the environment and would make it harder for the government of various countries to censor the network.

To this effect, if you want to run a node, you’ll need to stake 32 eth and keep it locked till after the merge is complete. Remember that the rewards would go to these stakers after the merge and not the miners.

How to benefit from the merge:

Deposit ETH by signing the transaction that allows the protocol to stake to a validator for you.

Receive the liquid wrapper that represents your right to the staked ETH.

Allow the staked ETH to accrue interest.

Use the liquid wrapper on any Defi protocol of your choice to earn more interest.

It is important to note that staking rewards is also expected to increase from approx 5% to 7-12% after the merge

Lucas Outumuro from intotheblock has the best model for ETH post-merge yield out there so far. Also, if you want a view how good Ethereum did in the year 2021, check out Josh Stark’s post.

Non-biased supply and demand heading into the merge

Over the years, a lot of ether has been distributed across more than 144.7m recorded wallets and a majority of those wallets have not been in months and in some cases, years! Only 6.5% has been active in the past 5-7 years despite all the volatility.

Before you begin arguing why you should buy or sell $eth, i want you to go through this tweet from CroissantEth and SquishChaos.

But from a trader’s perspective, we tend to look for discounted or overvalued assets to trade. Currently, Ethereum looks like a discounted asset. The major sellers (miners) would lose their ETH issuance and therefore there might be lesser selling pressure. If demand remains constant or is even slightly increased, there might be a bullish trade to be made here before market fully prices it in as it is now clearly one of the most crowded trades out there. When entering a crowded trade, one must have his/her limits well defined so as not to fall prey to those that clearly has theirs defined.

Possible trade idea?

Remember that this is not financial advice. I’m just laying out ideas I feel would be worth looking into.

Full on bullish: A scenario where the upgrade is a full on success and sentiment is very high. In this case, buyers are repeatedly front run as retracement gets shallower and liquidity exits other chains to go into the Ethereum network.

Bullish apes: A scenario where sentiments are pretty high but demand is not spot driven. It’s basically derivatives speculation. In this case, I’ll probably expect a drop post-merge to rinse out the leverage apes and then dips are bought up pretty quickly as Holders buy more and stakers realize that they need more of those juicy interests.

Buy the rumor sell the news event: Basically a blowoff top

Buggy event. Huge selloff

Delays? Another selloff

Key Takeaway

Transition from PoW to PoS

Energy usage to drop by 99.5%

ETH becomes more deflationary

Ethereum becomes more decentralized

A lot of complex tech is still ongoing

Miners won’t need to sell eth to cover energy cost. Instead they might invest it into the PoS system to earn more interest.

Staking rewards to increase to 7-12% from 5%

The Merge doesn’t lower fees. That’s the work of sharding and we have to wait till 2023 for that.

When is the merge happening?

The merge is planned for Q2 2022.

Last week, devs tested the merge event on the kiln testnet and it was a success. Once the merge is presented to the public, stakers will be assigned to validate the Ethereum Mainnet and mining will no longer be required.

Conclusion:

With complexity comes problems. Since Ethereum was created, a lot of complexities has been piling on each other as each EIP is released. This has passed a point of no return and would get to it’s breaking point at some time. For now, let’s enjoy the value creation. Let’s enjoy the volatility. Let’s enjoy the monies!

So basically this is a green for only ETH because sharding is not yet done 😑

Thanks for this Sir, but doesn't Ethereum moving to POS mean more centralization as not many people can afford the 32Eth requirement.