TLDR:

Bridgeless Interoperability on Bitcoin

Atomic swaps

Cross-chain liquidity network, powering other DEXs and bridges while aggregating the liquidity of each

Non-custodial Peer-2-Peer swaps

AMMs on Cross-Chains

Multi-chain money market aggregation

Intercommunication between blockchains

Bitcoin's success as a digital store of value is undeniable.

Over the years, we’ve seen increasing acceptance and adoption by institutional investors and even so, the global market. Since its inception in 2009, Bitcoin has steadily gained adoption and now boasts a market capitalization exceeding $1.1 trillion.

But here’s the thing. Unlike Ethereum and the likes of it, Bitcoin remains somewhat of an unproductive asset with minimal utility.

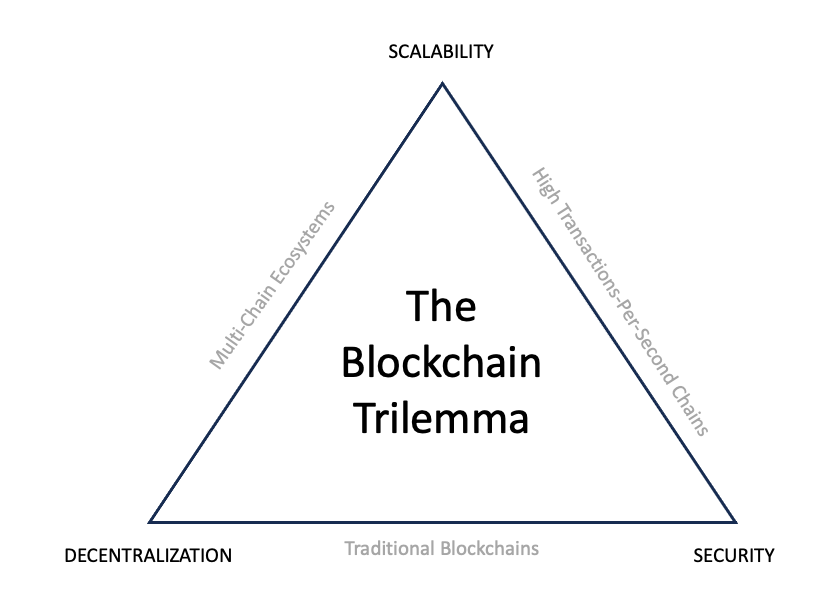

The problem here lies in the scalability trilemma.

The scalability trilemma is a concept that describes the challenge faced by blockchains in achieving three critical properties simultaneously:

Scalability: This refers to the network's ability to handle a growing number of transactions efficiently without significantly increasing transaction costs or times.

Security: A robust blockchain needs strong defences to prevent malicious actors from tampering with the network.

Decentralization: This is the core principle of blockchain technology. It means that control over the network is distributed among all participants, rather than being concentrated in a single entity.

The trilemma states that it's difficult, if not impossible, to achieve all three properties perfectly at the same time. Often, improving one aspect comes at the expense of another.

For Bitcoin, its core design prioritizes security and decentralization at the expense of scalability.

Bitcoin's blockchain has a capped block size, restricting the number of transactions included in each block. Currently, Bitcoin can only process about 7 transactions per second (TPS). This is far less compared to traditional payment systems like Visa, which can handle thousands of TPS.

With limited space in each block and competition for inclusion, the network becomes congested and transaction fees rise, making small transactions impractical. This in itself, is a significant barrier for DeFi applications, which rely on frequent and fast transactions.

This scaling problem was recognized by some of Bitcoin's earliest adopters, including Hal Finney, the recipient of the first Bitcoin transaction.

Recognizing these limitations, developers have proposed and built various scaling solutions for the Bitcoin network. Two prominent approaches are :

L2s (e.g Lightening network & Sate Channels)

Sidechains

Layer-2 solutions are built on top of the main Bitcoin blockchain (layer-1). They process transactions off-chain, batching them together before settling them on the main chain. This significantly increases transaction throughput and reduces fees. However, the security of these L2 transactions ultimately relies on the underlying Bitcoin network.

Sidechains, on the other hand, are separate blockchains that run alongside Bitcoin. They have their consensus mechanisms and can offer faster transaction processing and potentially more advanced features like smart contracts. However, security on a sidechain depends on the specific design and the federation of validators responsible for the sidechain.

Now, while these scaling solutions offer faster and cheaper transactions for Bitcoin, they exist outside the main chain. This creates a need for interoperability. Specifically, omnichain interoperability.

Interoperability is the ability of different blockchain networks to communicate, share information, and interact seamlessly with one another.

For Bitcoin to fully participate in DeFi, it must interoperate with its scaling solutions and more versatile networks like Ethereum and its L2s e.g. Abitrum.

This is where Portal Network comes in…

Portal Defi

Until 2020, the primary avenue for crypto trading had been centralized exchanges (CEXs), which posed significant risks. Decentralized exchanges (DEXs) were designed to mitigate these risks but introduced new hazards, particularly with cross-chain bridges and wrapped tokens which caused losses of ~$2.6B and accounted for 69% of the total hacks in 2022 alone.

The largest cross-chain bridge hacks in 2022 included:

Wormhole Bridge: $325 million stolen in February 2022 by exploiting vulnerabilities in the bridge's smart contract.

Nomad Bridge: $190 million was stolen in August 2022 due to a flaw in the bridge's smart contract that allowed anyone to drain funds.

Binance Bridge: $586 million stolen in October 2022 by exploiting a vulnerability in the bridge's smart contract.

Since all these hacks are happening, there has to be a problem right?

Well, to use cross-chain bridges, a token must be locked on its original blockchain, after which a corresponding wrapped token or synthetic asset is generated on the target chain. This wrapped token is then deposited into a liquidity pool on the target blockchain, making it accessible for trading, transfer, or redemption for the corresponding underlying asset from the source blockchain (Wrapping generally incurs the expense of two gas fees/mining fees/transaction fees; one on each chain. Unwrapping, or redemption, again incurs the same).

Note that the two blockchains are independent, internally consistent systems that do not depend on external data to maintain or alter their contract states or order of transactions. There is no enforcement of the peg or redeemability at the protocol level on either chain. Usually, either a single entity or a group of entities “guarantees the trust” in the peg between the wrapped token and the original token and its redeemability.

This is usually where the attack vector comes in…

Since there have been several instances of wrapped token attacks and bridge failures, there is a need for atomicity as opposed to bridges for cross-chain swaps.

Founded in 2019, Portal Defi aims to solve this challenge by offering a decentralized trust-minimized infrastructure that facilitates peer-to-peer native swaps of tokens across various blockchains without the need for wrappers, bridges, or centralized exchanges.

Since this is built around Bitcoin infrastructure, can it unlock DeFi on Bitcoin?

To answer that question, we must first understand how Portal works

The Portal Ecosystem

"We should put resources toward a proper (trustless, serverless, maximally Uniswap-like UX) ETH <> BTC decentralized exchange. It's embarrassing that we still can't easily move trustlessly between the two largest crypto ecosystems." - Vitalik Buterin March 25th, 2020

Portal Defi is the bridgeless interoperability protocol on Bitcoin.

Its ecosystem is an integrated and sophisticated suite of technologies built around Bitcoin innovations. The main components are:

Portal Network (Native Chain Contracts & Network Participants)

PortalOS

Portal swap SDK

Portal Network

Remember, Bitcoin's core design prioritizes security and decentralization, but at the expense of scalability, limiting its utility for frequent and fast transactions required in DeFi applications.

Portal addresses this through an innovative use of Atomic swaps and sidechains to avoid overloading the Bitcoin network itself. Hence, the portal network’s design for Omnichain interoperability hinges on the capability to atomically exchange assets held by mutually untrusting owners across different ledgers.

These swaps are called "atomic" because they are designed to either complete fully or not at all, eliminating the risk of one party defaulting on their part of the trade.

So, what is the Portal Network?

The Portal Network is a peer-to-peer network of independent nodes organized into a validator set. This network reaches consensus on the state of the Attestation Chain and maintains AMMs on supported blockchains.

This involves several key participants who play distinct roles in its operations, ensuring smooth and secure asset swaps across different blockchains. They are:

Traders

Validators

Liquidity Providers

Traders are asset holders who use Swap Clients to place swap orders on the Portal Network. They interact with the network by agreeing to quotes and signing transactions that prove their ownership of tokens and payments.

Validators are servers operating the Portal State Chain module. Validators manage the routing of these orders and maintain the decentralized order book. There can be up to 42 active Validators who participate in the protocol based on their stake.

Liquidity Providers (LPs) are users who lock up native tokens to facilitate the exchange functionality for others by providing liquidity. They earn rewards based on the duration and demand for the liquidity they provide.

Facilitators/Peers are users who run Portal Node (PortalOS). They help decentralize the network and enhance routing efficiency.

Now, the key innovation in Portal’s interoperability design is the use of highly customized AMMs on each chain, which collectively form a Multi Chain Layer-2 AMM (MC-LAMM).

To facilitate this, Layer-1 contracts are deployed on each supported chain, and then the outputs of these contracts are used for Layer-2 atomic swaps. Now, this is unlike the vault models used by some cross-chain solutions.

On the Bitcoin network, the native contracts used are Multi-Party Hash Time Lock Contracts (MP-HTLCs), which enable cross-chain trades by generating spendable outputs. Ethereum and other EVM chains use smart contracts that mirror the logical structure of Bitcoin's MP-HTLCs.

Remember, an HTLC is a conditional crypto transactional agreement wherein the receiver or the beneficiary is required to acknowledge the receipt of payment before a predetermined time or a preset deadline. On the other hand, MP-HTLC lets multiple users exchange tokens on different blockchains in a single instantiation of the protocol without any leader election.

Validators play a crucial role in this system.

They manage the routing of swap requests and orders, maintain order book synchronization, and guarantee execution on the Attestation Chain. This setup allows for customized AMMs on each chain without incurring high transaction fees.

Validator slots are permissionless, meaning any operator with sufficient $XPORT tokens can bid for a slot and become a Validator through regular auctions.

Validators perform several other critical functions:

On the Attestation Chain, they maintain and update the State Chain through a Proof of Stake consensus, reach a consensus on incoming deposits, and register them on the chain. They also reach a consensus on proposed transactions to sign and broadcast.

On the Settlement Chains, Validators participate in TSS (Threshold Signature Scheme) Keygen ceremonies to create MP-HTLCs on Bitcoin and smart contracts on EVM chains. They also participate in TSS Signing ceremonies to move funds for the protocol.

The Validators on the Attestation Chain maintain records of who provided liquidity, the amount, and the period, using Bitcoin block time as the universal clock.

You should also note that MP-HTLCs are similar to standard HTLCs used in Layer-1 Atomic Swaps but involve distributed secret and public key generation steps, triggered whenever the Validator set changes.

The Validator set generates a secret from hidden inputs, which all Validators can then hash using SHA-256 for the MP-HTLC. The public key generation involves a threshold signature scheme (Schnorr) and occurs with each epoch’s Validator set selection.

Compared to other protocols, this modular design supports multiple trading mechanisms and types, including P2P order books, relay-based cross-chain DEXs, and AMM-based Omnichain DEXs.

PortalOS

"An operating system is the layer of software that manages hardware resources, provides essential services to applications, and ensures efficient and secure operation of a computer system."

— Andrew S. Tanenbaum, Modern Operating Systems

PortalOS is an operating system designed to support the Portal Network.

The key components of the PortalOS are:

Peer edition

Co-ordinator

Relayer

The Peer edition is configured for use by end users and runs on a server owned by the user. It handles orders, swaps, and associated services. It also has tools like Faucet, and Explorer e.t.c and includes running nodes for various blockchains such as Bitcoin, Lightning, Thunder, Raiden, and Arbitrum.

The next critical part of PortalOS is the coordinator, which is a server that maintains a decentralized order book and provides additional services such as liquidity for lightning channels. The Co-ordinator also handles cross-blockchain message passing between AMMs on different chains, ensuring smooth interoperability.

The Relayer component offers an endpoint that processes Swap Intent information and returns an extrinsic hash after submitting it to the State Chain.

This role, while straightforward, involves a significant challenge: preventing blockchain spam. To maintain network integrity, Relayers pay a small transaction fee of the protocol’s native token each time they submit a Swap Intent extrinsic, and these fees are periodically burned.

For trade completion, Portal relies on L2 Path Finding Services (PFS). In cases where the L2 network lacks capacity, service providers can offer a Path Finding Service to potential LPs.

The system also includes a Price Feed Oracle, which aggregates real-world prices for trading pairs, helping Validators reach consensus on incoming orders. The sources of these price feeds range from centralized to decentralized, and Validators can choose the Oracles they prefer.

However, for assets with limited liquidity or those not yet trading, the Price Feed Oracle is less effective. In such cases, traders can trade against the AMM to discover prices until external prices from centralized or decentralized exchanges appear, though this can result in slippage.

This entire swap logic and payments are managed by Settlement Contracts on individual chains supported by the Portal Network. Traders interact with these contracts through their Swap Clients using the Portal Swap SDK.

Portal Swap SDK

An SDK is like a Lego set for programmers. It provides them with pre-built building blocks that they can snap together to create new and innovative applications, without having to start from scratch.

The Portal Swap SDK is a kit of libraries and tools designed to empower developers to seamlessly integrate and interact with the various functionalities of the Portal Network.

One of the core components of the SDK is the Swap Clients library, which encapsulates the common functionality needed across different client platforms like iOS, Android, and Web. This library simplifies the process of building applications that can place swap orders, manage transactions, and interact with the Portal Network.

While Swap Clients can operate independently, they can also integrate with Peers to enhance functionality, particularly benefiting liquidity providers and power users.

You can find the SDK here.

Tokenomics and Network Incentives

Incentives, like invisible hands, guide participants towards actions that benefit the entire ecosystem. Secure the network, get rewarded. Validate transactions, earn tokens. Build useful applications, attract users. - Kyrian Alex

Keeping through to its interoperability state, the Portal Defi plans to have an erc-20 token called $XPORT, to serve as its utility currency.

The emission schedule of $XPORT will follow a fixed supply model with a decaying issuance rate, akin to Bitcoin's halving mechanism.

This means that initial minting starts with 6.3% of the initial supply and decreases by 3% per epoch until the total emission target of approximately 840 million tokens is reached. This gradual reduction is designed to balance early incentives for Validators with long-term supply management and sustainability.

Validators earn rewards through the minting of new $XPORT tokens, triggered by specific network events such as epoch ends or network upgrades. These rewards incentivize Validators to actively participate in network governance and operations, thereby securing the network.

Another critical feature of Portal's tokenomics is its deflationary mechanism through token burning. Half of the fees generated from swap transactions are used to purchase and burn $XPORT tokens periodically. This burning process reduces the total supply of $XPORT over time, potentially increasing its scarcity and value.

Validators are also held accountable through a slashing mechanism, where negligent behaviour such as extended offline periods or failure to fulfil network duties can lead to the slashing of their staked tokens. Slashed tokens are permanently removed from circulation, reinforcing the deflationary aspect of $XPORT and penalizing misbehaviour.

Blockchains and L2s to be supported are:

Bitcoin

Lightning

Ordinals & BRC20

Ethereum

Arbitrum

Aeternity

Conclusion:

In January, Portal Defi raised $34 million in a seed round, bringing Portal's total funding to $42.5 million, adding to the $8.5 million raised in pre-seed funding in 2021.

The focus of Portal’s fundraising efforts has consistently been on the development of a decentralized exchange (DEX) to facilitate atomic swaps without relying on trusted intermediaries for cross-chain asset transfers.

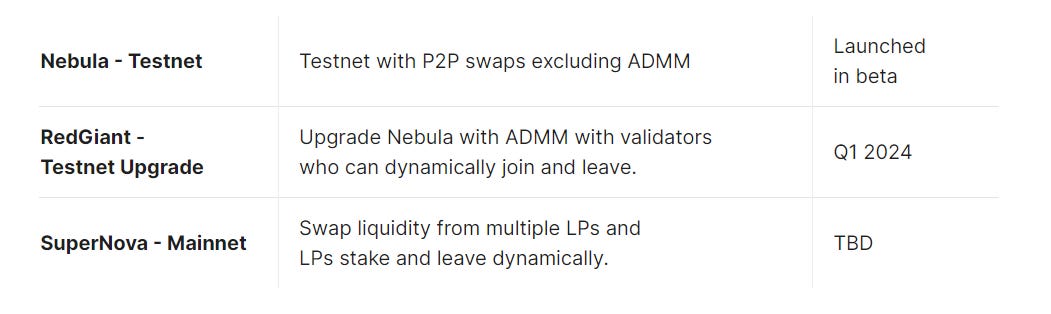

But after more than four years, 2 rebrands, and $42.5 million in funding, Portal’s DEX remains in the testnet phase, with audits yet to be released.

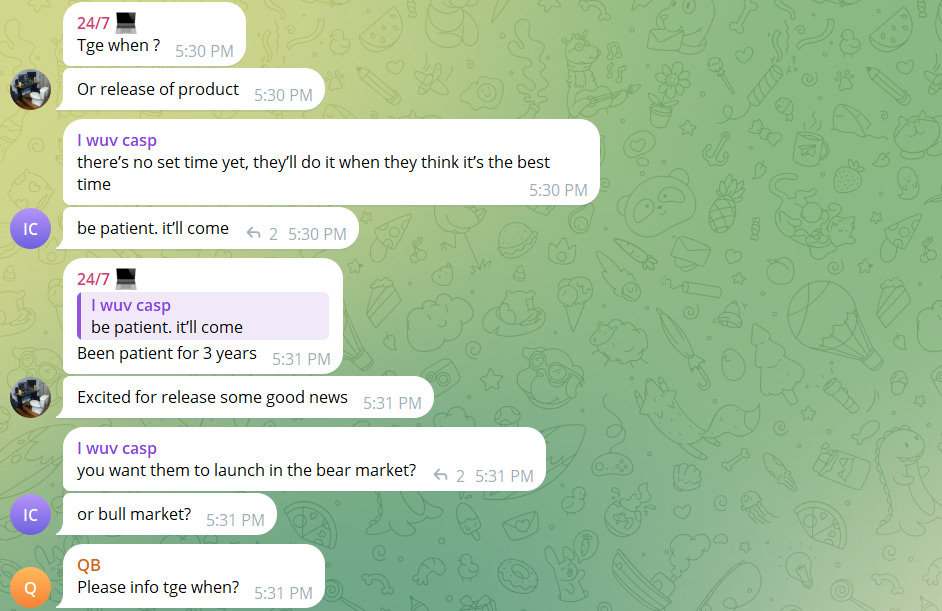

Following the announcement of their latest fundraising, some members of the Portal community expressed frustration on the project's Telegram channel regarding the slow pace of development.

Of what good is a “solid” product when it isn’t released yet?

Although this is concerning, Chandra Duggirala, the CEO and co-founder of Portal, acknowledged the delays and attributed them to the difficulty of the engineering problems. He clarified that the platform was expected to be mainnet-ready at some point this year and was presently going through rigorous testing, audits, and the configuration of its validator network.

Currently, Portal is the only custody-less interoperability protocol building for Bitcoin. It is clear that their vision is to bring about hyperbitcoinization.

Investors have always wanted defi to come to Bitcoin. They will come if the Portal team decides to keep up with the timeline this time and deliver a product that works.

If this works, it will ensure that DeFi applications on Bitcoin can operate with the same level of sophistication and reliability as those on more flexible blockchains like Ethereum. By doing so, Portal can transform Bitcoin from a primarily unproductive asset into a versatile participant in the DeFi ecosystem.

Portal is backed by Coinbase Ventures, OKX Ventures, Gate.io, Arrington Capital, and many other prominent investors.

References:

https://docs.portaldefi.com/references

https://portaldefi.com/